TUESDAY, JULY 29, 2014, 9:24AM

by GEORGE BOLLENBACHER

If anyone had any doubts about the impact of regulatory change on the swaps markets, they only need to read ISDA’s recent research paper, Revisiting Cross-Border Fragmentation of Global OTC Derivatives: Mid-year 2014 Update. The paper makes it clear that regional attempts to regulate a global market can have unintended consequences.

Here are some of their findings about the IRS market:

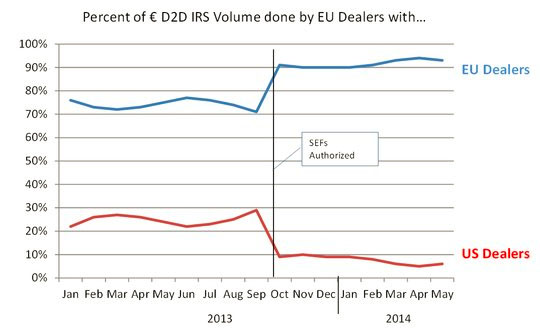

- The average volume of euro IRS transacted betweenEuropean dealers as a percentage of total euro IRS volume was 75% between January 2013and September 2013. In the period following the implementation of the SEF rule – October2013 through January 2014 – this average rose to 90%.

- The MAT determinations appear to have exacerbated euro IRS market fragmentation. Theaverage European-to-European interdealer volume as a percentage of total euro IRS volume increased to 93% between February 2014 and May 2014.

- The average cross-border volume of euro IRS transacted between European and US dealers as a percentage of total euro IRS volume was 25% from January 2013 to September 2013.In the period following the implementation of the SEF rule, this average fell to 9% between October 2013 and January 2014.

- The MAT determinations drove average European-to-US interdealer volume even lower, to 6%, between February 2014 and May 2014.

- European dealer volume with Canadian dealers in the market for euro IRS has steadily increased since August 2013, while US dealer volume with Canadian dealers has trended lower.

- The market for US dollar IRS is US-centric, whereas the market for euro IRS has a more global character and is thus more prone to fragmentation. Like euro IRS, European dealers primarily trade US dollar IRS with other European dealers, albeit to a lesser degree.

- US dollar IRS volume between European dealers increased after the October 2013 SEF rule came into force, but normalized in the months following the February 2014 MAT determinations.

- SEFs continue to be US-centric liquidity pools, with reported US dollar IRS trades accounting for over 70% of IRS volume traded on these platforms.

- The MAT determinations have also affected the average percentage of euro IRS trading on SEFs. Trading in euro-denominated IRS decreased once the MAT determinations came into force – from 13% to 9% – as liquidity continued to move away from US persons.

There are some other representations that show the effect. The graph below shows the percent of € IRS volume done by EU dealers with US and EU counterparties , and shows a sharp change in October, when the US SEF rules went into effect, and another , smaller, change when the MAT rules went into effect. The same graph for $ IRS shows no such change, because the SEF rules are US-centric.

But there is another impact of regulatory change. To quote the ISDA report, “Total cleared euro IRS volumes have declined 43% over the entire analysis period, while total cleared US dollar volumes have risen 15%. On a cumulative basis, euro IRS volumes decreased by 25%, while US dollar IRS volumes increased by 43%.”

The report draws the following conclusion: “The October 2 effective date for SEF compliance has clearly had an impact on trading relationships in the OTC derivatives markets. Our updated empirical analysis supports recent December 2013 ISDA survey findings indicating that liquidity has further fragmented following the first MAT determinations coming into force

on February 15, 2014. Trading between US persons and non-US persons has declined. Most notably, fragmentation is disrupting the market for euro interest rate swaps as liquidity pools have become more exclusive among European dealers.”

The report doesn’t address the D2C market, but there is no reason to assume that it is much different than the D2D market. Of course, the world isn’t standing still, so these results may not be the last word. Under MiFID II the EU anticipates requiring exchange trading in swaps, perhaps by the end of 2015, which might actually exacerbate the regional fragmentation. In

the meanwhile, everyone seems to be playing home games while they can.