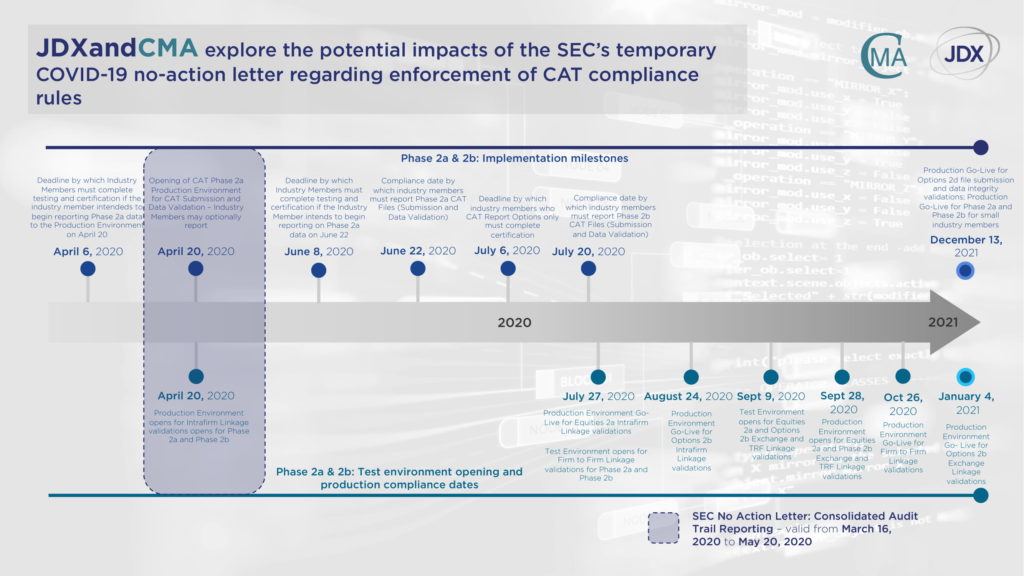

On March 16, in acknowledgement of the impact of COVID-19 on market participants and their need to implement business continuity plans, the SEC issued a no-action letter for CAT reporting, valid until May 20, 2020, without deferral of any subsequent compliance dates – inadvertently creating a potential bottleneck, with reporting firms likely having to deal with remediation activity for phases which had already gone-live, while simultaneously having to prepare for subsequent compliance dates for which there was no relief or deferral. On April 20, in acknowledgement of those unintended consequences, the SEC changed its approach, issuing a statement that it had voted in favour of issuing two exemptive orders establishing a delayed start to CAT reporting, with a phased reporting timeline for broker dealers, and permitting introducing brokers to follow the small broker-dealer reporting timeline, conditional upon meeting certain requirements.

JDX and CMA explore the impact of the no-action relief and exemptive orders on the CAT reporting timeline and provide some insight into where they think that reporting firms should focus their efforts.

For further information, please contact us and download the full article here: [download id=”1991″]