Posted by admin on Dec - 2 - 2020 - Comments Off on FRTB White Paper – Banks Regulatory Capital Calculations Just Got More Complicated Again

FRTB will be far more challenging than traditional risk capital regulations due to the lack of regulatory clarity over the boundaries between banking and trading book, the need for consistency across risk data sources, data modellability to prepare for complex risk calculations, and new governance to address changes in data structures and technology infrastructure. In our recent White Paper, Ice Data Services, Baker McKenzie, LP, Alveo and Capital Markets Advisors,… Read More »

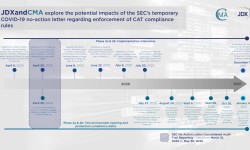

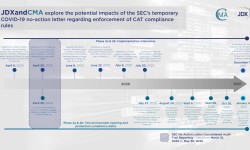

Posted by admin on Apr - 29 - 2020 - Comments Off on JDX and CMA explore the potential impacts of the SEC’s temporary COVID-19 no-action letter regarding enforcement of CAT compliance rules

On March 16, in acknowledgement of the impact of COVID-19 on market participants and their need to implement business continuity plans, the SEC issued a no-action letter for CAT reporting, valid until May 20, 2020, without deferral of any subsequent compliance dates – inadvertently creating a potential bottleneck, with reporting firms likely having to deal with remediation activity for phases which had already gone-live, while simultaneously having to prepare for… Read More »

Posted by admin on Jul - 27 - 2018 - Comments Off on Blockchain and GDPR’s Collision Course TabbForum

The General Data Protection Regulation, or GDPR, in Europe and distributed ledger technology are on a collision course. In its mission to secure individuals’ data, GDPR’s principles around data ownership, control and protection seemingly are in fundamental conflict with the ideals of blockchain’s distributed network, says George Bollenbacher, partner, Capital Markets Advisors. Speaking with TABB Group founder and research chairman Larry Tabb, Bollenbacher explains the complexities of regulating data on… Read More »

Posted by admin on Jul - 24 - 2018 - Comments Off on Coming Out Party: the Debut of the Sonia and SOFR

With all the regulatory upheaval in the recent past, present, and near future, the last thing the markets need is another fundamental change in the rules of the game, but that’s exactly what we have in the projected retirement of some (but not all) of the various interbank offered rates (IBORs) by the end of 2021. While not a change in the regulations per se, this change may actually have… Read More »

Posted by admin on Sep - 27 - 2017 - Comments Off on Understanding Market Evolution

Participants in the world’s financial markets are facing a period of unprecedented challenges, affecting not only the markets for financial instruments but even more the markets for financial services. These challenges, while often appearing unconnected, are actually evidence of a complicated process of evolution in the markets. Capital Markets Advisors Partner George Bollenbacher’s guide to “Understanding Market Evolution: A Scientific Approach” is devoted to understanding market evolution and covers the following… Read More »

Posted by admin on Sep - 11 - 2017 - Comments Off on It’s Complicated – Reporting Complex Trades Across the Globe

Among the regulatory requirements that have crept up to bite us, none appear to be more troublesome than the reporting of complex trades. With global regulators attacking the issue independently, disparate requirements are complicated and often unclear. CMAs George Bollenbacher breaks down just how complicated reporting obligations can be. Check out the full article on TabbForum here: https://tabbforum.com/opinions/its-complicated-reporting-complex-trades-across-the-globe

Posted by admin on Jun - 2 - 2017 - Comments Off on Dealing With EU Market Regulations

Having trouble following and understanding all of the new market regulations coming out of Europe? Looking for a guide to MiFID? MiFID II? MAR? MAD? Download and read through CMA’s new EU Regulations Series in which George Bollenbacher explores various EU market regulations and their effects. [download id=”1837″]

Posted by admin on Feb - 21 - 2017 - Comments Off on CCP Resolution: SCUBA Diving in Murky Waters

What happens if and when one of the large CCPs runs into a major default by one or more of its members? George Bollenbacher, CMA’s Head of Regulatory Reform, takes a deep dive into the risks and regulatory requirements. https://tabbforum.com/opinions/ccp-resolution-scuba-diving-in-murky-waters

Posted by admin on Oct - 26 - 2016 - Comments Off on Market Evolution Series, Part 6: Methodologies for Success

Understanding market evolution is critical for all market participants’ survival. But only if firms become accustomed to an ongoing evolutionary effort will they start to see the real benefits. Check out the final article in the exciting “Market Evolution” series where CMA’s George Bollenbacher lays out guiding principles to help firms respond to market evolution. https://tabbforum.com/opinions/market-evolution-series-part-6-methodologies-for-success

Posted by admin on Oct - 11 - 2016 - Comments Off on Blockchain: Where Do We Stand?

Excellent video interview from TabbFORUM with CMA partner, Mike Zimits, on the future of Blockchain in the industry and how firms can utilize this technology to get the most out of their investments https://tabbforum.com/videos/blockchain-where-do-we-stand