CMA’s Enterprise Data Services Practice centers mainly on our expertise in managing reference data (client & product), corporate actions data, market data, and research data. With poor quality data potentially costing firms up to 20% of their revenues, focusing on enterprise data management can dramatically improve the success of those firms. In the current climate, the need for measuring the risk of bad data has become ever more pressing. A… Read More »

CMA resources have years of direct, front-line experience as well as a deep knowledge of the financial industry. This enables us to provide a global approach to client solutions with quick turn around. From strategy to operations, we are committed to helping our clients build their functional skills and boost performance for the long term. CMA Can Provide Our Clients With: Resources with extensive experience in Prime Brokerage Resources with… Read More »

The Wealth Management and Private Banking have been severely affected by the current turmoil in financial markets. Margins are under pressure due to depressed asset prices that reflect poorly on portfolio performance measurement. Clients are shifting money to safer but lower profit products like fixed income. Bankruptcies and liquidation of assets to cover other positions have reduced assets under management (AUM). Client attrition rates are high and the clients that… Read More »

CMA aims to help firms with effective tax methodologies that will allow them to decrease risk and maximize profits. Our resources are qualified to assist our clients in all major aspects such as transfer pricing, cross-border taxation, indirect tax and taxes associated with mergers and acquisitions. CMA is knowledgeable about the various tax regulations and controls; we are well equipped to deal with the various government-imposed constraints. We are also… Read More »

Our resources cover all aspects of the regulatory reforms, OTC derivatives market and the impact of using a central counter party (CCP). Our resources consider the benefits and business opportunities associated with OTC clearing, as well as the implications of the reforms on IT systems, risk management and regulatory compliance. All financial institutions recognize that they must have some form of OTC clearing and collateral management solution in place by the… Read More »

Volatility in the world financial markets has led to a growing scrutiny of the financial services industry, raising costs for institutions that fail to adhere to mounting regulatory requirements. Firms must implement a rigorous, robust solution that limits exposure to potential fines yet does not harm their competitive position or economic value. Failure is expensive. Recently, financial service firms paid over $250 million annually in fines for failing to comply… Read More »

Since the financial collapse in 2008, financial institutions have faced real challenges including the need to manage cross-asset risk allocation and meet new regulatory requirements and control operational risk. CMA provides a broad range of services that enable our clients to deal with highly complex packages and integrations by aligning strategy, information, technology and processes across the business. CMAs’ team has a deep understanding of the functional process and technology… Read More »

Below is an example of a Large Scale Conversion Project performed by CMA resources for an Investment Bank. The scope of this project was to replace their back office systems and re-engineer the processes that support risk management; core banking and lending, treasury operations and financial reporting with a new vendor package for back office operation, corporate lending and general ledger system. Our Approach: Established PMO and governance structure and… Read More »

In response to market changes and new legislative mandates, financial institutions want to evaluate their current collateral activities, leverage current strategic initiatives, and be able to create an industry leading collateral solution for their clients across product and business lines. A new operating model will require fundamental changes to collateral management’s organizational structure, systems, processes, and people/skill sets. We understand that a financial institution’s primary objective for this type of… Read More »

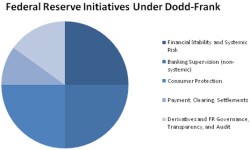

In order to remain competitive in today’s global marketplace, financial institutions have greatly expanded the scope and complexity of their services and activities resulting in an ever changing and increasingly complex regulatory environment. Furthermore, due to the 2008 financial crisis, consumer credit crisis, several high profile compliance breakdowns and increased emphasis on consumer protection, the federal and state regulatory agencies, investors, legislators and the general public are today more focused… Read More »